Pay stubs might seem like simple documents, but they hold important information for both employers and employees. For small businesses and self-employed individuals, understanding pay stubs provides clarity and control over finances.

This article breaks down the basics: what pay stubs are, when you need them, and what details matter for streamlined payroll and tax preparation.

A pay stub is a document that provides a detailed breakdown of an employee's earnings and deductions for a specific pay period. It acts as a record and proof of payment for both the employee and employer.

Pay stubs can be physical documents attached to a paycheck or, more commonly, accessible electronically through online payroll systems .

Here's a breakdown of why pay stubs are important for both employers and employees:

As an employer, understanding the key elements of a paystub is crucial for accurate payroll management and legal compliance. Let's delve into the components that form the backbone of this essential document:

This section establishes your business's identity for tax and record-keeping purposes. Clearly display:

These are ssential details to ensure the correct person receives the correct payment and that their records are accurate:

The earnings statement is the core calculation showing how the employee's gross pay was determined. Clearly outline:

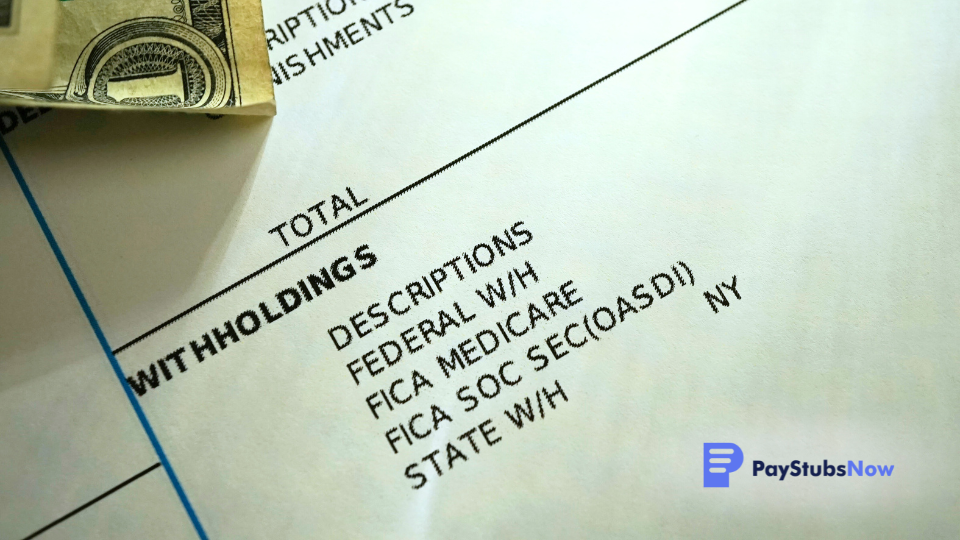

This section is the itemized breakdown of amounts subtracted from gross pay, clarifying the final "take-home" amount.

This is the final "take-home pay" amount the employee receives. Calculate it by subtracting all deductions from gross pay.

Simplify tax season preparation by providing cumulative figures for gross earnings, taxes withheld, and other deductions throughout the year.

While the federal Fair Labor Standards Act (FLSA) doesn't mandate providing paystubs, many states have their own specific regulations regarding them. Understanding your state's laws is crucial for employers. Here's a general categorization of state laws:

The best way to determine your specific state's requirements is to consult the following:

Creating accurate paystubs requires a few essential practices.

Whether you have employees or work independently, streamline Pay Stub creation with tools like free customizable templates, spreadsheets (Excel or Google Sheets), or affordable payroll solutions. For those seeking a ready-to-use solution with easy customization, consider services like Paystubsnow 's pay stub generator.

Accurate paystubs rely on meticulous tracking. Implement a system (manual logs, apps, or project management software) to record work hours or billable time per project. Maintain organized records of all payments, clearly associating income with specific projects or clients.

Small business owners and self-employed individuals alike need to understand tax responsibilities. This includes payroll taxes for employees, self-employment taxes, the potential for quarterly estimated tax payments, and tracking deductible business expenses. Paystubsnow offers features that can assist with calculating these deductions.

Establish a secure method for storing paystubs, income records, tax-related information, and employee payroll documentation (if applicable). Options include physical filing, cloud-based storage, or accounting software with integrated document management features.

Regularly review all paystubs (for yourself or your employees) to catch potential errors. Consistently track overall income and expenses and regularly reconcile these records with paystubs to ensure a clear financial picture and accuracy with tax reporting.

Making a pay stub can be simple and effortless by using the intuitive Paystubsnow platform. Let's dive in on how to create one.

Start by selecting the perfect template for your needs. Paystubsnow offers seven customizable templates to choose from, ensuring you find a design that fits your preferences. Each template is clear, professional, and fully customizable to match your business requirements, including adding company branding and logos.

Once you've selected your template, the next step is filling out the company details. You'll be required to enter your company's details, including the legal name, address, contact information, and Employer Identification Number.

This includes the employee's name, address, employee identification number, social security number (or a part of it for privacy), pay period, pay date, marital status, and the number of exemptions based on their W-2 or W-4 form.

This step involves entering the specifics of the employee's earnings. Paystubsnow's templates will have sections for regular income, overtime, bonuses, and other payments. You'll need to input the pay rates and hours worked, along with any other payment to the employee. Paystubsnow will automatically calculate deductions based on the earnings you input, including social security taxes, Medicare, and state and federal taxes.

Before you hit the submission button, make sure all information you have entered is accurate. This step is important because it guarantees that your pay stub aligns with the employee's true earnings and deductions. Any inaccuracies could lead to potential discrepancies in the future, so take a few extra moments to ensure everything is correct.

Once satisfied with the preview, you can generate the paystub. No waiting time, no fuss. Paystubsnow allows you to download the pay stub in PDF format for digital record-keeping, printing, or email forwarding.

If you encounter any issues with the calculations or the template, reach out to our 24/7 support team by clicking the orange chat icon in the bottom right corner or email support@paystubsnow.com.

Dreading payroll headaches? Paystubsnow streamlines the process, letting you create professional paystubs in minutes. Choose from various templates, enter employee details, and watch the platform automatically calculate deductions and net pay.

Eliminate manual calculations and errors, ensuring accurate and compliant paystubs for employees, contractors, and yourself.

Ready to simplify your payroll? Generate paystubs now.

Disclaimer: Even though tax professionals use and trust Paystubsnow, we are not a CPA (Certified Public Accountant) firm. Our website helps you make paystubs, invoices, W2s, and 1099 forms easily. We don't give out legal or tax advice. It's a smart idea to talk with your own CPA, tax person, or lawyer to make sure you're doing everything right by the law.