What information is included on a paystub?

Unless you get paid cash daily as a day laborer or something similar, you will receive a paycheck stub detailing your pay stubs. The check might be an old-fashioned paper check, although these are increasingly rare. More than likely, your compensation will be provided through direct deposit, accompanied by paper pay stub to outline the details.

Regardless of the form of payment, the employer will provide pay stubs to summarize your earnings and deductions. (Believe it or not, some states- Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, Ohio, South Dakota, and Tennessee- do not require check stubs. There is also no federal requirement for them.)

Once you know what information is included on a paystub and how to interpret it, a pay stub serves as a powerful tool for managing employee's wages and employee benefits. It is the best method to ensure you are compensated correctly for your hourly employees' workload and the specific pay period.

You can also use a paystub to make certain that you are not overcharged for the various programs that are often deducted from a paycheck. People make mistakes, including employers. A check stub is the best way to make sure that you do not pay for other people’s mistakes. It is wise to check your check stub against any personal records you keep, such as a personal log of hours worked; do not just rely on the time clock.

Paycheck stubs are also crucial as they serve as proof of income and are essential for financial verifications. This is particularly useful when applying for loans or interacting with tax authorities to handle federal income taxes and state income tax payments.

At first sight, a paystub (or check stub) can be baffling. All of those lines, numbers, and abbreviations! But with a little guidance, and perhaps your reading glasses, paystubs are actually pretty straightforward.

A pay stub, often termed a paycheck stub, is the official record detailing an employee's paycheck and compensation. Every pay period, you'll get a paystub. Your pay stub example will display the pay period's total earnings, deductions like tax withholdings, and your net income after those deductions.

GENERAL INFORMATION

Generally, a paystub will list standard identification information about both employer and employee. For employers, this includes the name of the company, the address, the EIN (or employer identification number), and so on. On the employee side of the line, you might see your name, the last four digits of your Social Security Number, home address, etc.

The check stub will also list the pay period in question. This could be weekly, bi-weekly, etc. depending on the employer.

A check stub will also include the rate of pay and number of hours worked. If you are paid hourly, the paystub will list your hourly wage and you just multiply that by the number of hours worked to get your gross pay. If you are a salaried employee, your weekly pay is generally the same no matter how many hours you worked, so the stub, by default, usually lists 40 hours as the number worked.

GROSS PAY

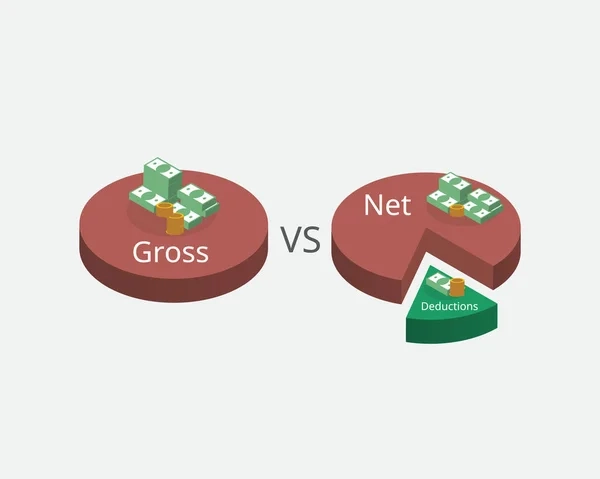

The first item you will find on your paystub is gross pay. This is the full amount of your pay before any deductions have been made from it. Examples of deductions are Federal Taxes, State Taxes, Medicare, FICA (or Federal Insurance Contributions Act.) You might also have deductions for health insurance and retirement accounts like 401k and Roth, pension, or 403b. Typically, the pay stub outlines your gross wages for the current pay period and the accumulated amount year-to-date

TAXES WITHHELD

After general information and gross pay, a check stub details the various taxes withheld from your paycheck. Again, a paystub might show the current pay period and year-to-date calculations.

FEDERAL INCOME TAX WITHHELD

This will be the next category on your check stub. The federal income tax deducted varies based on your earnings, in accordance with federal laws. Generally, the more you make, the higher the rate of taxation. Minimum federal income tax rate is 10%. The current maximum federal income tax rate is 37%. The number of dependents chosen on your IRS W-4 form also affects your total federal income tax.

Generally, the employer will calculate how much your annual income will be. That number will show which tax bracket (percentage to be taxed: from 10 to 37%) you are in. Multiplying your total annual income by your tax bracket rate will tell the employer your total estimated annual federal tax bill. The employer then looks at how many pay periods there will be that year and divides the total federal tax bill by the number of pay periods. The resulting sum is the amount of federal income tax to be taken out of each paycheck.

Of course, things change over the course of a year. Often, people end up being taxed at too high a rate. So, some of this tax burden may be returned to you during tax season in the form of an IRS refund. But for now, you have to pay for it.

STATE TAX WITHHELD

This tax deduction varies widely from state to state. Florida, for example, has no state income tax. While in California, the state with the highest state income tax, the state income tax rate is 13.3%. So, this will differ among various paystubs. It can also be impacted by the number of dependents you declared.

FICA TAXES

FICA taxes, under the Federal Insurance Contributions Act, are another deduction from your gross income. FICA taxes break down into two categories: Medicare tax and Social Security tax.

MEDICARE

Medicare is a health insurance program at the federal level, intended for people 65 years old and up. The Medicare tax rate is 1.45% of your gross income. (If your annual income is more than $200,00, you pay an additional 0.9% Medicare surtax.)

SOCIAL SECURITY

Social Security is the federal program that provides income to retired and some disabled people. The Social Security tax rate is 6.2% of your gross income.

LOCAL TAXES

Depending on your location, you might also observe deductions for local income taxes from your pay. Cities like Chicago and New York City have comparatively high local taxes, while many localities have no additional taxes at all.

INSURANCE DEDUCTIONS

Additional deductions from your gross earnings might include insurance premiums for different employee benefits such as health or dental insurance. Depending on your employer, you might have the opportunity or obligation to buy into various several kinds of insurance coverage. Many employers, for example, offer a health insurance option. The employer generally pays part of this cost and the rest is paid by you, the employee. You could also have vision or dental or even life insurance plans, each of which involves a deduction from your gross pay. Note that these deductions for insurance are taken out of your gross pay. The result is that you do not pay taxes on this part of your pay.

CHILD CARE DEDUCTION

You might also arrange for pre tax deductions for child care expenses from your gross wages, which shows pre tax deductions clearly on your pay slip. Again, this avoids paying tax on whatever amount of money it is that you spend on childcare.

EXAMPLES OF OTHER DEDUCTIONS

Making charitable contributions, which are often matched by employer contributions, through payroll deductions is becoming more popular in workplaces. Oftentimes, the company will match your contributions to select charities. Charitable contributions you make through your company will also be deducted from your paycheck. This will be reflected on your paystub.

There are other examples of where possible deductions from gross pay might come from. One is an HSA or health savings account. Employees can, through the payroll department, set aside part of their gross pay (thus, pre tax dollars) to go into the health savings accounts (HSA). These accounts are a way to save money to be used for health expenses somewhere down the line. They are a sort of rainy-day health care account. Any money earmarked for an HSA would be reflected on your paystub.

WAGE GARNISHMENT

Wage garnishment is another potential deduction from an employee's pay, mandated by legal orders, which shows pre tax deductions on the pay statement. According to the U.S. Department of Labor, “Wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support.” If you have a tax debt or owe child support, it can be withheld from your gross wages. Any income that is garnished is still taxed, unlike the deductions for insurance, child care, etc.

STATE DISABILITY INSURANCE

Some states, including California and New York, offer state disability insurance, which is a state and local requirement. These states include California, Hawaii, New York, New Jersey, and Rhode Island. State Disability Insurance is meant to provide short-term disability coverage if something unfortunate happens. If applicable, state disability insurance will be listed as a deduction on your wage statement, as required by some states.

ADDITIONAL INCOME

Occasionally, overtime hours or corrections might lead to adjustments for back pay, which are reflected in your payroll records. This adjustment could be due to an oversight previously missed by the payroll department. Or maybe you got a retroactive raise that the employer needs to catch up on. In any case, on your check stub, you might see the back-pay category add something to your gross income.

On occasion, you might get a bonus, sick pay, or even vacation pay. If so, this will be listed on your paystub. Generally, it is subject to the same deductions as regular pay.

NET PAY

So, these are the slices taken from the gross pay pie. The amount left over, your actual paycheck or direct deposit, is called NET PAY. This net pay is what you've been waiting and working for, factoring in all taxes paid and deductions from your gross income. Consider saving some of your net wages—don't spend it all at once!

How to Determine Your Net Salary

You can predict the size of your paycheck by using websites that calculate the deductions that will be taken from your salary.

Calculators for paychecks make it easy to figure out how much money will be deducted for things like taxes, FICA, healthcare, retirement, etc. You can use these calculators to see how much additional money will be in your check if you are eligible for overtime pay.

These tools can be helpful for tax preparation since you can compare your withholdings to their suggestions. If you find that you are withholding too much or too little from your check, you can adjust your withholdings.

Change Your Withholding Tax

You must complete a W-4 Form whenever you start a new job or wish to modify how much tax is deducted from your paycheck. This will specify how much money should be taken out of your check as tax and benefit deductions from your employer.

Before completing the form, it's a good idea to get down with your spouse and figure out the proper withholdings. To help you avoid paying more at tax time, the IRS also provides a free tax withholding estimate tool.

Why You Might Need a Paystub

Why you might need a paystub to apply for a loan or to find home It's possible that you will be required to submit copies of paystubs from a specific time period when you apply for a loan, rent an apartment, or buy a property. This is evidence that your income is high enough to cover the cost of the mortgage, rent, or loan.

Employers may ask for recent and current paystubs in order to confirm employment and wage history.

To confirm the accuracy of the information: In order to be prepared in case you ever need to confirm your salary or deductions, it's a good practice to get into the habit of reading a paystub and maintaining a physical or digital copy. When you start a new job, this is especially crucial so you can verify that all the deductions on your first paycheck are accurate. Additionally, it's a good idea to keep copies of your paystubs in case your employer makes a mistake and you need to consult the record while resolving the issue with HR.

How to Download a Paystub

Do you require a copy of a paystub to verify your employment or for a credit application? Check if you can access and download your pay stubs, which meet the pay stub requirements, from the employee section of your company's website or through the payroll provider's service if you haven't done so already.

Ask your employer's Payroll or Human Resources department if they can give you copies of your paystubs or a login to see them online if you can't find any.

Are Paystubs For Your Employees A Requirement?

Clearly, paystubs give your employees a wealth of useful information. But are pay stubs required by federal government or Fair Labor Standards Act regulations?

The Fair Labor Standards Act, or FLSA, mandates that business owners keep account of the hours their employees put in, but how they do so is ultimately up to them. But even though paystubs aren't required by federal law, most states—including California—do—including California.

Therefore, for each pay period worked, you must give your employees an itemized a paystub if you own a firm in California. Pay statements offer substantial advantages, such as documenting employer contributions and employee contributions to retirement savings and flexible spending accounts, even if they weren't mandated.

Every pay period, you can easily keep track of the hours, wages, taxes, and deductions of your employees by issuing paystubs via your payroll provider. You may more quickly identify any errors or disparities and fix them before you run into any problems—with your employees, your benefit partners, or the IRS - by keeping an eye on your employees' gross earnings and net compensation.